In our article, we will discuss the Annual Compliance for Limited Liability Partnership (“LLP”)

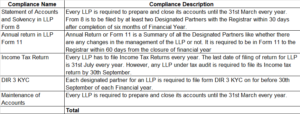

An LLP is a separate legal entity. To maintain active status, regular filing with MCA is required to keep compliance and escape heavy penalties under the law for non-compliance. Annual compliance with LLP is obligatory and unavoidable. Annual compliance for LLP needs filing of two forms:

- Annual returns

- Statement of accounts or financial statements

Filing LLP Annual return

Each LLP needed to file the annual return, also known as E-form 11, to the registrar within 60 days after closing the books of accounts of the LLP. Annual return declares briefly in statements by reporting any change in activities and management of the corporate for every financial year in coming years.

Filing statements of accounts

In preparation for a statement of accounts each year as of 31st March, LLP E-form 8 must be filed with ROC on or before 30th October annually. Moreover, LLP, whose yearly turnover of Rs. 40 Lakh must get their financial accounts examined by an accomplished chartered accountant compulsorily.

BENEFITS OF MAINTAINING ANNUAL FILINGS FOR LIMITED LIABILITY PARTNERSHIP?

Regular filing avoids penalties.

Regular filing of forms protects partners from being declared defaulters and avoids heavy penalties and fees. It also avoids further disqualification of contracts. All the filing and the documentation process should be taken care of for LLP.

The LLP and Partners should spend a good deal of resources obeying the rules and regulations. Regular checkups of amendments are significant as the law is very dynamic and changes from time to time.

Convertibility and settlement

The records of annual compliance filed each year simplify the process of conversion and the closure of the LLP. Generally, the registrar interrogates the fulfilment of annual compliance with an additional LLP fee before the conversion and settlement of the LLP.

Reliability

The Ministry of Corporate Affairs declares the status of annual compliance for LLP on its official portal. The ethics and morals of the LLP are dependent on annual compliance.

Notify creditworthiness

While entering into contracts, the companies or other contracting entities can approach the forms filled by the LLP to introspect the financial worth of the LLP. The record of financial statements forms a picture of net worth in the minds of interested parties before entering into a contract.

WHAT ARE THE PENALTY PROVISIONS OF ANNUAL COMPLIANCE FOR LLPS?

For MCA filings:

As per the Limited Liability Partnership Act, 2008, filing of E-Form 8 and E-Form 11 is a mandatory requirement for every registered LLP. Non-compliance with the LLP annual compliance leads to a penalty amount is 100 per day for every form not filed. No upper ceiling is specified for such a penalty amount.

For income tax filings:

The penalty for defaulting on filing income tax returns on time is two-fold- Rs. 5000 is to be paid by defaulters who miss the filing due date but do so before 31st December of each rear Rs. 10,000 is payable by LLPS that fails to stick to the extended deadline.

IS THERE ANY FORM OF COMPLIANCE RELATED TO THE CHANGE IN PARTNERS OF AN LLP?

Yes, there are compliance requirements related to the change in partners of an LLP. E-form- 4 must be submitted to the ROC within 30 days if there is any form of change in the partnership requirements of the LLP. E-form 3 also must be submitted to the ROC. This form relates to any rights and duties related to the partnership concern.

Hope this will help you to keep updated in compliance. If you have any further questions, please feel free to reach out to us.

Be a compliant Entrepreneur!

Happy Reading.

By-