In India, Employee Stock Options Plans (“ESOPs“) are among the most trending compensation methods. Earlier, ESOPs were used as a tool to hitch the senior management to make their pay competitive. But in the past few years, the trend is changed. Now the ESOPs are not only to retain the senior management but also extended to the employees, especially by the startups.

Many startups, including ShareChat, PhonePe, Wakefit, Licious, have recently awarded ESOPs to their employees, including administration, production, back-office etc. Infosys, one of the earliest Indian IT firms to offer ESOPs, also planning to expand its employee stock options to include a larger base of employees to retain the talent. “We already have ESOP (employee stock option) programmes today, which go to a lower level within the company, not at the entry-level, but a couple of levels above that. And that’s something which is a huge success for the company,” Salil Parekh, chief executive officer, Infosys, told ET in an interview last month.

ESOP is a non-cash equity-based compensation. When the company share price rises, plan participants share in the financial gains. When the share price falls, plan participants share in the loss. For this reason, employees at ESOPs are known as employee-owners because they share in the risks and rewards of ownership.

ESOPs certainly help structure a balanced compensation plan for the employees, including fixed and variable pay linked to the tenure in the company and performance or achievement of the pre-defined goals.

Before deep-diving into this concept, let’s understand few crucial terminologies:

- ESOP– ESOP is an abbreviation of Employee Stock Option Plan, which describe the employee benefit plan under which the company offer ownership interest to the employees in the company.

- Grant of options– Grant refers to the grant of employee stock options by entering into an agreement between company and employee. The date of signing the agreement or a specific date mentioned, as the case may be, is the grant date.

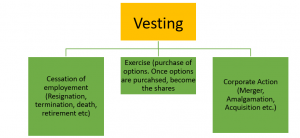

- Vesting of options– Vesting means the entitlement or right, not the obligation to buy options, after fulfilling the conditions set out in the agreement or grant letter. The date on which an employee is entitled to purchase the options is the vesting date.

- Vesting period- means the time gap between the grant date and vesting date.

- Exercise of option- Exercise of option means the purchase of vested options by the employees.

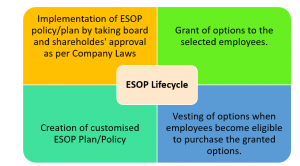

ESOP Lifecycle-

Example-

- Preeti has been granted 400 ESOPs under the Company ESOP Plan via a grant letter dated May 20, 2021. The exercise price is the face value, i.e., Rs.10/-

- After one year from the date of grant, the options will vest uniformly over four years. So below is the vesting table along with the exercise price:

- Tax to be paid by Preeti- Let’s assume the fair market value (“FMV”) of the shares is Rs. 100 while Preeti has exercised the options at face value, i.e., Rs. 10/-. So Preeti will have to pay tax on the notional value of her income, i.e., the difference between the FMV and exercise price. Below is the mathematical description:

Total number of options- 400

Exercise Price per option– Rs.10/-

The total price paid by Preeti- 400*10=Rs. 4000/-

Fair Market value per share – Rs. 100/-

Fair market value of purchased shares- 400*100= 40,000/-

Now taxable amount- 40,000-4000= 36000

So now, Rs.36000 will be added to Preeti’s income, and Preeti shall be liable to pay tax as per her tax slab.

Preeti shall be liable to pay tax only on the exercise of options.

- Suppose in the future Preeti’s company provide liquidity by any means. In that case, the shares held by Preeti shall be transferred to the investor/promoters, and Preeti will receive the sale amount.

So, the profit or loss to Preeti will depend upon the company’s growth, FMV, and deal price.

Many companies are nowadays adopting a cash settlement of vested options for providing liquidity to their employees.

In the recent past, especially during pandemic, buyback has also been trending among the companies.

Conclusion-

So, ESOP is a win-win situation for both the company and the employee. At one part, it is the most trending method to retain employees and balance employee compensation plans; on the other side, it boosts personal wealth and improves job security.

If you are struggling with ESOP related issues, please feel free to reach out to us.

Happy Reading!

Pingback: fildena online buy

Pingback: order amoxil 250mg generic

Pingback: levitra vs viagra

Pingback: buy cheap online dapoxetine

Pingback: sildigra 120

Pingback: vidalista dose

Pingback: can women take vidalista

Pingback: vidalista 100mg

Pingback: malegra fxt 140mg

Pingback: fildena super active 200 mg

Pingback: cenforce 200

Pingback: fildena professional

Pingback: fildena Ч—Ч•Ч•ЧЄ Ч“ЧўЧЄ

Pingback: kamagra® gold

Pingback: is tadalafil good for women

Pingback: Sildenafil Prices in us

Pingback: vermact12

Pingback: amoxil antibiotics

Pingback: super kamagra jelly

Pingback: fildena super active

Pingback: stromectol without prescription

Pingback: lipitor generic

Pingback: cenforce 100 india

Pingback: extra super tadarise 40 mg

Pingback: spedra avanafil

Pingback: Cenforce online order

Pingback: benemid cost

Pingback: side effects of isotroin 10 mg

Pingback: priligy 60 mg buy

Pingback: cialis orange juice

Pingback: hydroxychloroquine sulfate 200mg

Pingback: sildamax 200mg

Pingback: sulfatealbuterol.com

Pingback: dorzolamide vs dorzolamide timolol

Pingback: pink eye drops medicine

Pingback: lasix water pill

Pingback: buy priligy

Pingback: mumbai kamagra

Pingback: viagra vs cialis

Pingback: how much are viagra pills

Pingback: tadalafil 10mg

Pingback: kamajelly.wordpress.com

Pingback: cialsuper.wordpress.com

Pingback: zithrom.wordpress.com

Pingback: lasiinfo.wordpress.com

Pingback: ivermin

Pingback: samsca uses

Pingback: profcial.wordpress.com

Pingback: viasuper.wordpress.com

Pingback: cathopic.com/@zhewitra

Pingback: forum.hcpforum.com/superpforcejelly

Pingback: fildena extra power 150 mg

Pingback: an351

Pingback: vigrakrs.com

Pingback: Azithromycin 600

Pingback: Cheap clomid without prescription

Pingback: buy viagra - One step forward brings you closer to true confidence.

Pingback: cialis for women

Pingback: vermact 12 dosage

Pingback: otclevitra.com

Pingback: cenforce360.com

Pingback: Vidalista black 80 vs super kamagra

Pingback: albuterol inhaler cost

Pingback: tadalafil super active

Pingback: Levitra for erectile dysfunction

Pingback: tamoxifen emc

Pingback: penegra 50 mg use in hindi

Pingback: ivert 12 mg

Pingback: kamagra super 100 mg

Pingback: probenecid uses

Pingback: an 354

Pingback: lasix 40mg furosemide

Pingback: Vidalista 40

Pingback: Zithromax

Pingback: lipitor medicine price

Pingback: amoxil capsule

Pingback: effet secondaire tadalafil

Pingback: olimelt 7.5

Pingback: cialis 100mg tadalafil oral jelly

Pingback: albyterol.com

Pingback: nolvadexotc.com

Pingback: filitra

Pingback: buy dapoxetine hydrochloride

Pingback: Vidalista online

Pingback: cenforce d 160

Pingback: cenforce 100mg

Pingback: Vidalista black 80 opinie

Pingback: where to buy priligy

Pingback: Cenforce 100

Pingback: ivercid a tablet

Pingback: lasix 40mg

Pingback: prelone pediatric dosage

Pingback: buy cheap dapoxetine

Pingback: revatio

Pingback: suppressive therapy for hsv 1

Pingback: lantanaprost

Pingback: tadalista 60

Pingback: super p force next day

Pingback: generic Levitra

Pingback: Cenforce d 100

Pingback: Vidalista kopen

Pingback: duricef 500 antibiotic guidelines

Pingback: ventolinha.wordpress.com

Pingback: zithromaxday.com

Pingback: levitraoffer.net

Pingback: stromectoluk.com

Pingback: sibluevi.com

Pingback: lasixotc.com

Pingback: medsmir.com

Pingback: synthroiduuu.com

Pingback: clomidzsu.com

Pingback: hfaventolin.com

Pingback: dapoxetineus.com

Pingback: vidalista.lol

Pingback: donpharm.com

Pingback: zithromaxotc.com

Pingback: lyricabrs.com

Pingback: cenforceindia.com

Pingback: iwermectin.com

Pingback: flagylzub.com

Pingback: prxviagra.com

Pingback: experienceleaguecommunities.adobe.com/t5/user/viewprofilepage/user-id/17928318

Pingback: forum.hcpforum.com/dapoxetine

Pingback: experienceleaguecommunities.adobe.com/t5/user/viewprofilepage/user-id/17932546

Pingback: ummalife.com/post/521081

Pingback: dynamitesports.com/groups/kamagra-sildenafil-citrate/

Pingback: buy amoxil

Pingback: prescription drugs for depression

Pingback: prednisolone pills

Pingback: priligy

Pingback: proscar brand name

Pingback: cenforce 100

Pingback: vermact

Pingback: kamagra jelly oral 100mg

Pingback: almox 25

Pingback: Nolvadex in spanish

Pingback: silagra 100 price in bangladesh

Pingback: kamagra jelly

Pingback: over the counter metronidazole gel

Pingback: cialis super force

Pingback: Vidalista dosering

Pingback: revatio 20 mg tablet

Pingback: +38 0950663759 – Володимир (Сергій) Романенко, Одеса – Купив у цього шахрая — в переписці обіцяв робочий, отримав неработаючий пристрій. Зберігаю

Pingback: lasix 40mg us

Pingback: 50 mg viagra instructions for use

Pingback: cialis black box warning

Pingback: buy Cenforce 100 online free

Pingback: isotroin sunscreen

Pingback: how quickly does proscar work

Pingback: 20 mg cialis price

Pingback: hydroxychloroquine sulfate tablet 200 mg

Pingback: Vidalista dosering

Pingback: Probalan

Pingback: cialis oral jelly